A different rate of participation in the increase of the underlying asset's value is determined separately for each type of investment deposit and the interest that will be transferred to your account at the end of the deposit term together with the deposited amount also depends on this.

The amount of interest is calculated using the following formula:

deposited amount x participation rate x [(final value of underlying asset – initial value of underlying asset)/initial value of underlying asset] = deposit interest.

For example, if you invest EUR 1000 into an investment deposit whose participation rate in the increase of the underlying asset's value is 55%, the initial price of the underlying asset is 100 and the final price of the underlying asset at the end of the deposit term is 122.15, then interest on the date the deposit ends is EUR 121.825:

1000 x [(122.15 – 100) / 100 ] x 55%= 121.825

No interest is paid on the deposit if the interest calculated on the basis of the above formula is zero or less.

Unlike direct investments in securities, the amount that you place in an investment deposit is always 100% guaranteed if kept for the full term of the deposit, even in the case of unfavourable market conditions. And if the price of the underlying asset increases, it is possible to earn an interest that is significantly higher than the interest paid on other deposits. Investing in an investment deposit also means that you do not have to open a securities account or pay any other charges that are usually associated with direct investments in securities (such as transaction charges and entry and exit fees in the case of transactions with fund units).

The risks in the case of an investment deposit are credit risk, market risk and tax risk. The most significant risk of these four is the market risk – the risk that the price of the underlying asset does not move in the desired direction resulting in the decrease or loss of interest, and in the case of an investment deposit with risk premium you may lose the entire risk premium, and the interest paid at the expiry of the deposit contract may be smaller than the risk premium you paid.

The next investment deposit expired on 3 July 2008. Its underlying asset was the Swedbank Russia Equity Fund. The interest rates of the deposits with a risk premium were EUR 22.74 and USD 31.12% and the interest rates of deposits without a risk premium amounted to EUR 8.84% and USD 15.61%.

You can view earlier investment deposits here.

Investment deposits are always subject to the risk that the market conditions will become unfavourable and you may therefore not earn any interest. It means that the rates of return of investment deposits are not guaranteed as a rule (except for the investment deposits with a guaranteed rate of return), but the majority of investment deposits have earned interest.

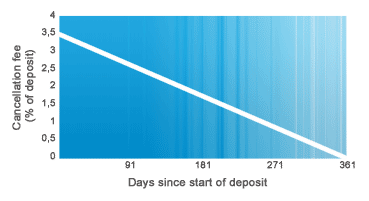

You may cancel the deposit free of charge during its sales period. If you wish to cancel your deposit after the start date of the deposit term, you will have to pay a cancellation fee that equals a certain percentage of the deposited amount as set out in the terms and conditions of offer. If the interest you have earned until the moment of cancellation exceeds the cancellation fee, then the interest remaining after the payment of the cancellation fee will be paid to you. For example, 8% of the interest will be paid out to you if the interest your deposit earned prior to cancellation was 15% and the cancellation fee 7%.

The amount of the cancellation fee depends on how much time is left until the end date of the deposit – the closer the end date, the smaller the cancellation fee you have to pay.

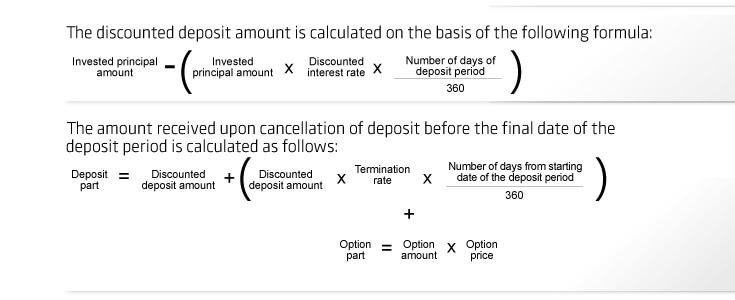

An investment deposit consists of two components: the deposit part and the option part.

As the invested principal amount is 100% guaranteed on the end date of the deposit term, the bank deposits a part of the deposit amount invested by the client (the discounted deposit amount).

Discounted deposit amount – the invested principal amount that has been discounted with the bank's discounted interest rate for the relevant currency during the relevant period that is effective on the last selling date of the deposit.

Discounted interest rate – the bank's interest rate for the relevant currency during the relevant period that is effective on the last selling date of the deposit in discounted form.

Where

Termination rate – bank's interest rate for 1 year

Option price – known only to the bank

Amount of options = deposit amount x participation rate

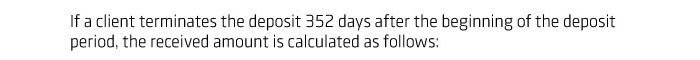

Example:

The invested principal amount is 1 000 euros

Duration of the investment deposit is 2 years (731 days)

The bank's two-year interest rate that is valid on the last selling day of the deposit is 5.5%

The bank's two-year interest rate in discounted form that is valid on the last selling day of the deposit is 4.95%

The termination rate is 4.75%

The participation rate is 55%

The option price is 9%

=> discounted deposit amount = 1 000 – (1 000 x 4.95% x 731/360) = 899.49 euros

=> amount of options = 1 000 x 55% = 550

-

Deposit part = 899.49 + (899.49 x 4.75% x 352 / 360) = 941.27 euros

-

Option part = 550 x 9% = 49.50 euros

Upon termination the client receives in total 941.27 + 49.50 = 990.77 euros.

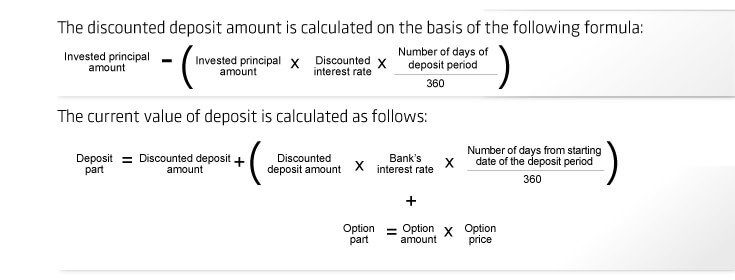

An investment deposit consists of two components: deposit part and option part.

Since the invested principal amount is 100% guaranteed on the final day of the deposit period, the bank deposits part of the amount invested by the client (discounted deposit amount).

Discounted deposit amount – invested principal amount discounted with the bank's discounted interest rate that is valid for a corresponding time period on the last selling day of the deposit.

Discounted interest rate – the bank's interest rate that is valid for a corresponding time period on the last selling day of the deposit in discounted form.

Where

Bank's interest rate – bank's interest rate for a corresponding period of time that is valid on the last selling day of the deposit

Option price – known only to the bank

Amount of options = deposit amount x participation rate

Example:

The invested principal amount is 1 000 euros

Duration of the investment deposit is 2 years (731 days)

The bank's two-year interest rate that is valid on the last selling day of the deposit is 5.5%

The bank's two-year interest rate in discounted form that is valid on the last selling day of the deposit is 4.95%

The participation rate is 55%

The option price is 9%

=> discounted deposit amount = 1 000 – (1 000 x 4.95% x 731/360) = 899.49 euros

=> amount of options = 1 000 x 55% = 550

-

Deposit part = 899.49 + (899.49 x 5.5% x 352 / 360) = 947.86 euros

-

Option part = 550 x 9% = 49.50 euros

The current value of the investment deposit 352 days after the beginning of the deposit period is

947.86 + 49.50 = 997.36 euros.

The money will be paid into your account in two parts: the deposit amount and interest. As the money will be paid into the account in the currency of the deposit, you have to make sure that payments to your current account in the relevant currency are permitted. Otherwise, the bank will automatically convert the money into euros and you may lose because of changes in the exchange rate.

Risk premium is a non-refundable extra charge for increasing your participation rate in the price increase of the underlying asset. You will earn more interest on a deposit with a risk premium than on a deposit without a risk premium if the price of the underlying asset changes in a favourable direction. However, you may lose the risk premium if the price of the underlying asset moves in an unfavourable direction and the interest paid upon the expiry of the deposit contract may be smaller than the risk premium you paid. Preservation of the principal amount of an investment deposit is guaranteed if you keep the deposit until its end date, but the risk premium is not.

You can invest in a new deposit at any time during the selling period that usually lasts for 4 to 5 weeks before the deposit is opened. You can invest in the deposit in the Internet Bank or at a branch of the bank. The minimum deposit amount for each investment deposit is set out in its terms and conditions of offer and the deposit will not be opened if the total investments made into the deposit remain below the minimum. The terms and conditions of offer also set out the smallest possible deposit amount that you can invest in the deposit and all other important terms and conditions that concern the investment deposit.

An investment deposit set up as of 1 January 2011 can be regarded as a financial asset. The interest paid on the investment deposit can only be regarded as a contribution to the investment account if income tax has already been withheld from it. The risk premium of the investment is recognised as an acquisition cost, which is not regarded as a payment from the investment account.